How Semiconductor Demand Fuels AI Data Center Growth

1. Why Consider Semiconductor Demand and AI Data Centers

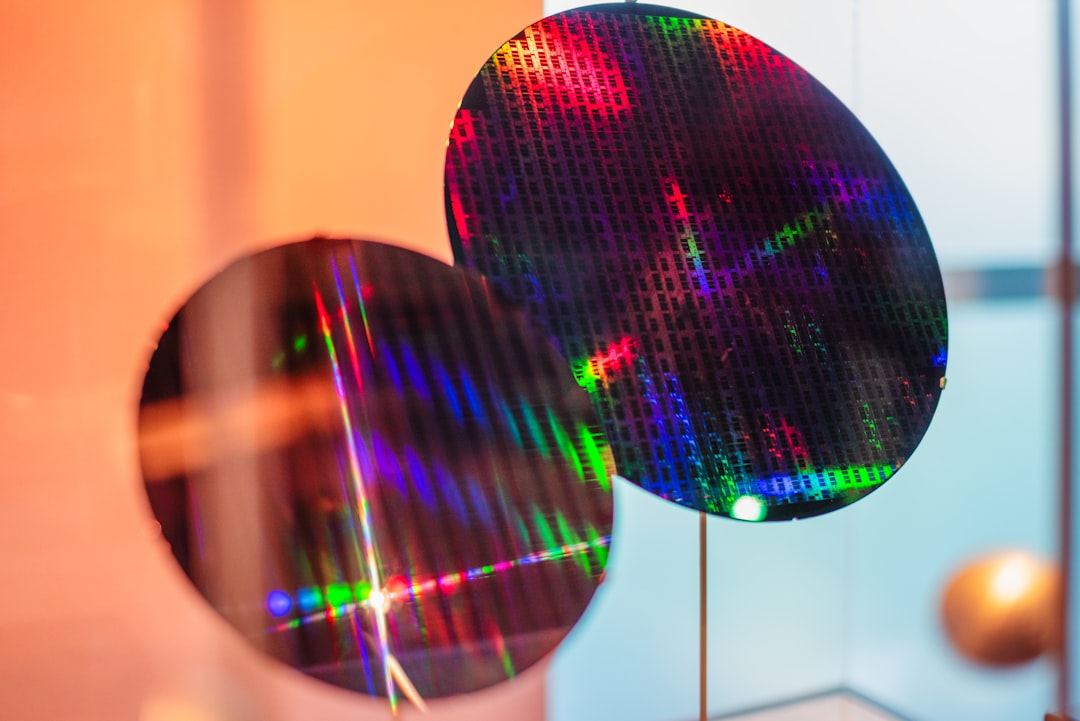

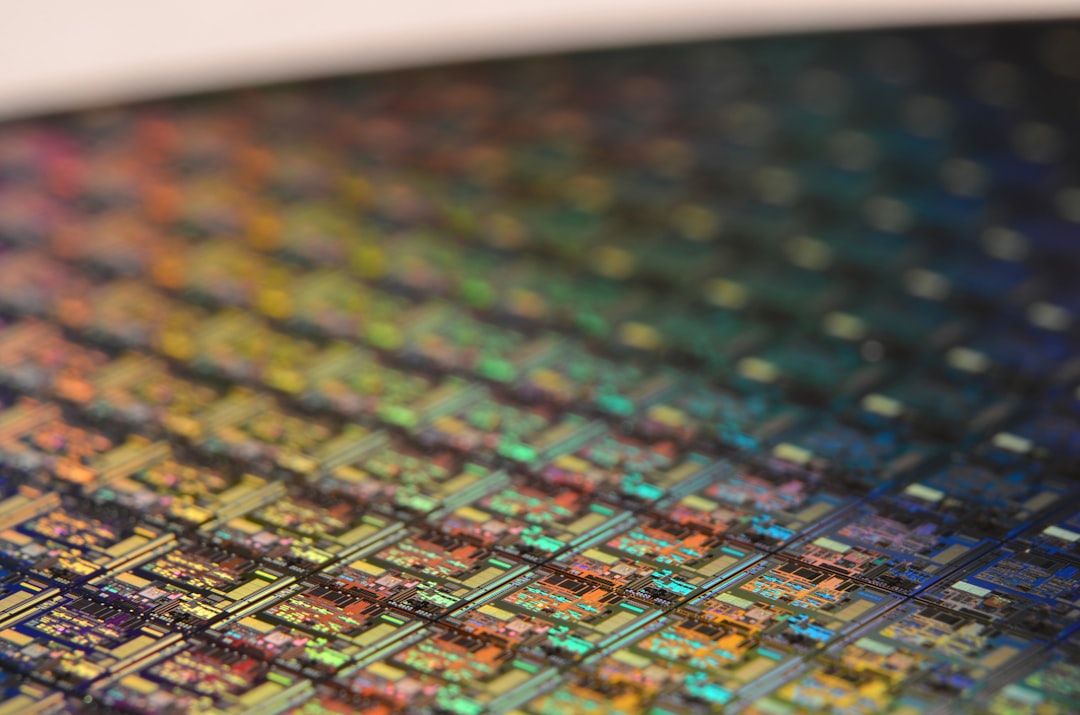

Investors may find it crucial to understand the interplay between **semiconductor supply** and the growth of **AI data centers**, as this relationship is becoming increasingly pivotal in shaping the future of technology. The demand for semiconductors has surged, driven largely by the proliferation of AI applications, which require powerful computing resources to operate effectively. As industries across sectors adopt AI technologies, the need for robust data centers that can handle extensive data processing has escalated.

The **semiconductor market** is currently experiencing remarkable growth, with companies like **Taiwan Semiconductor Manufacturing Company (TSMC)** potentially positioned to benefit significantly from this demand surge. Analysts suggest that TSMC could see an increase in revenue margins, possibly exceeding 10-15%, as it scales production to meet the needs of AI data centers. This is indicative of a broader trend where advancements in semiconductor technology are directly linked to enhancements in AI capabilities.

AI's transformative role across various industries cannot be overstated. As sectors such as healthcare, finance, and logistics increasingly integrate AI, the demand for high-performance computing resources tends to rise. For instance, **NVIDIA Corporation (NVDA)** has witnessed a stock price increase of approximately 27% over a six-month period, largely attributed to its robust position in the AI-driven data center market. This performance may suggest that the stock remains an attractive option for investors, as AI-related revenues continue to strengthen.

Furthermore, partnerships between software firms and hardware manufacturers, such as the recent agreement between **GIBO Holdings Limited (GIBO)** and **Ricloud AI Inc.**, may further enhance the ecosystem supporting AI applications. These collaborations could streamline the development of AI technologies, thereby increasing the demand for advanced semiconductor solutions.

In summary, the confluence of semiconductor demand and AI data center growth could lead to significant advancements in technology, with potential benefits for investors in related stocks and sectors. Understanding these dynamics is essential as the landscape continues to evolve.

2. Advantages and Disadvantages

Investors may find the landscape of semiconductor technology and artificial intelligence (AI) to be a double-edged sword, with both potential advantages and disadvantages that could significantly impact market dynamics.

2.1 Potential Advantages

- Increased Performance: Advanced semiconductors are critical for the efficiency of AI applications. The integration of cutting-edge chip technology can enhance computational speed and reduce latency, which may lead to improved performance in AI-driven tasks.

- Economic Growth: The semiconductor industry, driven by AI technology, could potentially stimulate economic growth. As demand for high-performance chips increases, this may lead to job creation and investments in infrastructure, further bolstering the economy.

- Investment Opportunities: For investors, the semiconductor sector presents potential opportunities. Stocks and exchange-traded funds (ETFs) such as SOXX (iShares Semiconductor ETF) may provide avenues to capitalize on the growing semiconductor market, which is projected to expand at a compound annual growth rate (CAGR) of approximately 5-7% over the next few years.

2.2 Potential Disadvantages

- Supply Chain Vulnerabilities: The semiconductor market is susceptible to supply chain disruptions, which could affect the availability of critical components. Investors should be aware that geopolitical tensions or natural disasters may lead to shortages, impacting production timelines.

- Environmental Concerns: The manufacturing processes associated with semiconductors can have significant environmental impacts. Issues such as water usage, chemical disposal, and energy consumption may raise concerns among environmentally conscious investors.

- Market Volatility: Semiconductor stocks can exhibit considerable volatility, often influenced by demand spikes. For instance, sudden increases in AI data center requirements could lead to rapid fluctuations in stock prices, potentially exposing investors to higher risk.

As the semiconductor and AI sectors continue to evolve, understanding these advantages and disadvantages will be crucial for investors seeking to navigate this complex landscape.

3. Practical Options/Methods

Investors may find the semiconductor sector to be a compelling area for exploration, particularly given the increasing demand for artificial intelligence (AI) technologies. The rise in AI data center requirements could position key players, such as Taiwan Semiconductor Manufacturing Company (TSMC), as significant long-term beneficiaries. With the ongoing surge in AI workloads, TSMC may capture a substantial market share, potentially leading to favorable revenue growth.

To gain exposure to this sector, investors might consider exchange-traded funds (ETFs) that focus on semiconductor companies. For instance, the SMH (VanEck Vectors Semiconductor ETF) and SOXX (iShares Semiconductor ETF) are two prominent options that track the performance of the semiconductor industry. These ETFs typically hold a diversified selection of stocks, which may mitigate some individual company risks while still allowing investors to capitalize on the sector's growth potential.

In addition to traditional investment methods, investors might also explore technological tools that enhance the efficiency of AI data center management. Companies like Vinci are at the forefront of this innovation, offering software solutions that can expedite hardware simulation processes. By significantly speeding up the design and testing phases of semiconductor chips, Vinci's tools could potentially streamline operations for data centers, ultimately reducing costs and improving performance.

Moreover, the performance of individual stocks in the semiconductor space can be indicative of broader market trends. For example, NVIDIA Corporation (NVDA) has recently experienced a notable surge, with growth attributed to its AI-driven data center solutions. Investors may view this as a bullish indicator for the sector, particularly as revenue and liquidity strengthen in response to heightened demand.

As investors consider these practical options and methods, it is essential to remain informed about the dynamic landscape of technology and finance. The interplay between semiconductor companies and AI advancements may continue to shape investment strategies moving forward.

4. Important Considerations

Investors considering investments in semiconductor stocks and exchange-traded funds (ETFs) should carefully evaluate several important considerations that could influence their investment outcomes.

4.1 Tax Implications

Understanding the tax implications of investments in semiconductor stocks and ETFs is crucial. Capital gains tax rates can vary significantly, depending on the holding period of the investment. Long-term capital gains, typically applicable to assets held for over one year, may be taxed at reduced rates ranging from 0% to 20%, while short-term gains can be taxed as ordinary income, potentially at rates up to 37%. Investors may wish to consult a tax professional to navigate the complexities associated with these investments.

4.2 Trading Fees

Investors should also consider the fees associated with trading or investing in semiconductor ETFs. Expense ratios for ETFs can range from approximately 0.05% to 1%, impacting overall returns. Additionally, trading commissions may apply, particularly for those trading through brokerage accounts that do not offer commission-free trades. These costs can accumulate, especially for active traders.

4.3 Investment Risks

Investing in semiconductor stocks and ETFs is not without risks. Geopolitical tensions, such as trade disputes or regulatory changes, can adversely affect supply chains and production capabilities. For instance, disruptions in semiconductor supply chains could lead to increased costs and reduced availability of products, potentially impacting stock performance. Furthermore, market volatility in response to news surrounding major players, such as Taiwan Semiconductor Manufacturing Company (TSMC), could also create additional uncertainty for investors.

4.4 Importance of Diversification

To manage these investment risks effectively, diversification is paramount. By spreading investments across various sectors and asset classes, investors may reduce the potential impact of negative performance in any single investment. For example, including a mix of semiconductor stocks alongside technology, healthcare, or consumer goods sectors could create a more balanced portfolio, potentially leading to more stable returns over time.

In conclusion, while the semiconductor sector may present compelling opportunities for growth, investors should remain vigilant about the associated tax implications, trading fees, risks, and the importance of diversification in their investment strategies.

5. Conclusion

In conclusion, the increasing demand for semiconductors plays a critical role in the expansion of AI data centers. As companies like HPE (Hewlett Packard Enterprise) and NVIDIA (NVIDIA Corporation) ramp up their AI capabilities, the need for advanced chip technology becomes paramount. For instance, the recent advancements like HPE's deployment of AMD's "Helios" AI rack-scale architecture illustrate how companies are leveraging semiconductor technology to enhance their AI offerings. This trend suggests that semiconductor manufacturers, particularly those like Taiwan Semiconductor Manufacturing Company (TSMC), may stand to benefit significantly from this surge in demand.

However, investors should maintain a balanced perspective regarding the advantages and disadvantages in the investment landscape. While the AI sector's growth is promising—with companies like NVIDIA witnessing a 27% increase in stock value over a recent six-month period—it is essential to consider potential market volatility and supply chain challenges. The semiconductor industry is known for its cyclical nature, which could lead to fluctuations in demand and pricing that may affect investment outcomes. For instance, while companies like Vinci, which recently raised $36 million to enhance hardware simulation, may emerge as key players, they also face competition and technological hurdles that could impact their growth trajectories.

Investors are encouraged to stay informed about market trends and technological advancements that could create strategic opportunities within the semiconductor sector. Ongoing developments, such as partnerships between firms like GIBO Holdings Limited (GIBO) and Ricloud AI Inc., could indicate a shift in how AI technologies are integrated into various applications, further driving demand for semiconductors. This evolving landscape provides a fertile ground for potential investment opportunities but requires diligent research and monitoring of market conditions.

As the AI data center market continues to grow, investors may find it beneficial to assess both the risks and rewards associated with semiconductor investments. Staying updated on industry trends and company announcements will be crucial as the landscape evolves, allowing investors to make informed decisions tailored to their risk tolerance and investment goals.

Disclaimer: This article was generated using AI technology and is for informational and educational purposes only. It does not constitute investment advice, recommendation, or solicitation. All investment decisions are solely the responsibility of the individual investor. Past performance does not guarantee future results. Investments involve significant risks, including the potential loss of principal. Before making any investment decisions, please conduct your own research and consult with qualified financial and tax professionals.