How Nvidia and Intel Compete in AI Chip Innovation

1. Why Consider AI Chip Innovation

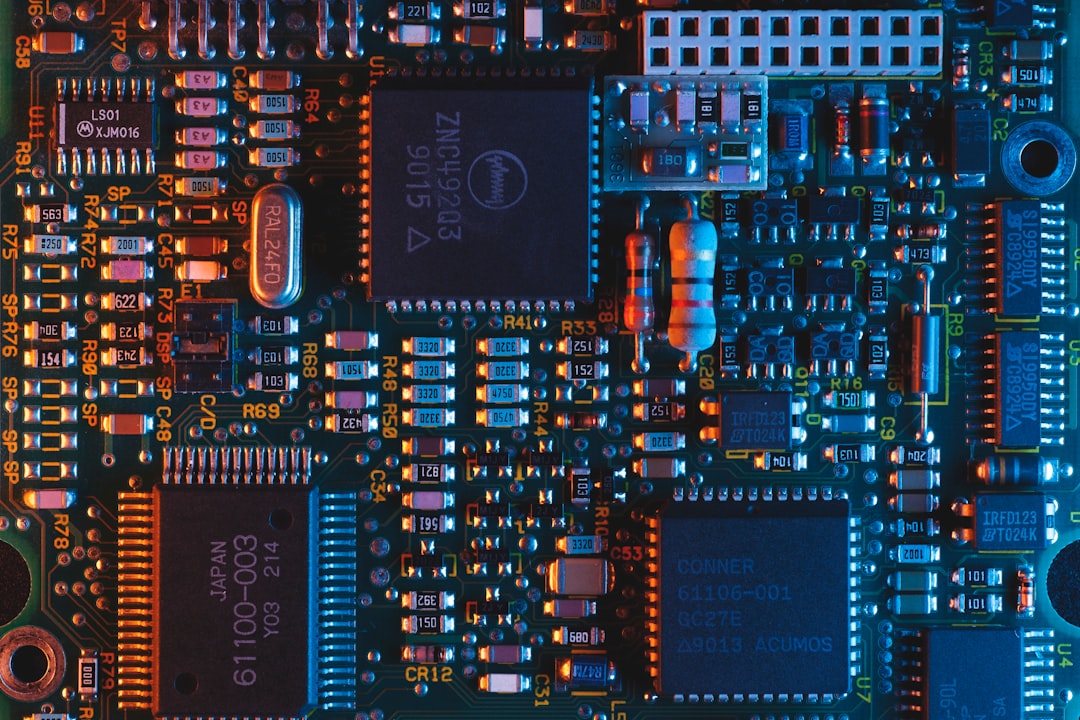

Investors may find it increasingly important to consider the innovation surrounding **AI chips**, as these components are fundamental to the advancement of various technologies and applications across multiple sectors. The surge in demand for artificial intelligence capabilities has resulted in a competitive landscape dominated by key players like **Nvidia Corporation (NVDA)** and **Intel Corporation (INTC)**. Understanding their strategies and innovations could provide insights into future market trends and investment opportunities.

AI chips are crucial for powering everything from autonomous vehicles to advanced data analytics. For instance, the market for AI semiconductors is projected to grow significantly, potentially reaching a valuation of approximately $70 billion by the end of the next few years. This growth is driven by the escalating need for efficient processing capabilities to manage large datasets and enhance machine learning algorithms.

The competition between Nvidia and Intel exemplifies the dynamic nature of the AI chip market. Nvidia has established itself as a leader with its cutting-edge graphics processing units (GPUs), which are essential for AI training and inference tasks. With approximately 90% of the market share in high-performance computing, Nvidia’s advancements in **tensor processing units (TPUs)** and other specialized chips may continue to set the pace for the industry. Meanwhile, Intel is working to close the gap by leveraging its extensive manufacturing capabilities and investing in innovative chip designs.

Moreover, as noted by various industry analysts, the rapid pace of innovation in semiconductor technology, particularly through companies like **Taiwan Semiconductor Manufacturing Company (TSMC)**, could potentially reshape the competitive landscape. TSMC's ability to manufacture chips at smaller nodes, typically around 5nm, allows for greater efficiency and performance enhancements, which may benefit both Nvidia and Intel as they vie for market dominance.

Looking ahead, Google CEO Sundar Pichai’s remarks on the transformative potential of AI suggest that these technologies may soon play a role in everyday decision-making, including investment choices and medical advice. As AI tools become more integrated into daily life, the demand for efficient and powerful chips could intensify.

As the landscape continues to evolve, investors may want to keep a close eye on the ongoing developments in AI chip innovation and the competitive positioning of key players. Understanding these dynamics could provide valuable context for potential investment strategies in the technology sector.

2. Advantages and Disadvantages

Investors may find it beneficial to weigh the potential advantages and disadvantages of leading companies in the AI chip market, such as Nvidia and Intel, as they navigate the evolving landscape of artificial intelligence infrastructure.

2.1 Potential Advantages

- Nvidia's GPU Optimization: Nvidia's graphics processing units (GPUs) are specifically optimized for AI workloads, which could potentially enhance performance and efficiency. This specialization allows for faster processing of complex algorithms, which is critical in applications such as machine learning and deep learning.

- Diverse Product Line from Intel: Intel (INTC) offers a diverse range of products, including traditional CPUs and specialized AI chips. This flexibility may enable Intel to cater to various applications across different sectors, potentially appealing to a broader range of customers.

- Strong Market Position: Nvidia has established a strong market position, controlling a significant share of the AI chip market, which may provide a competitive edge. As demand for AI technologies continues to rise, this position could translate into sustained revenue growth.

- Investment in R&D: Both Nvidia and Intel invest heavily in research and development, with Nvidia's expenditures reported to be around 20% of its annual revenue. This commitment to innovation may help them stay ahead of competitors and adapt to rapidly changing market demands.

2.2 Potential Disadvantages

- Increasing Competition: Nvidia faces mounting competition from other players in the AI chip market, which could lead to market saturation. As more companies enter the space, Nvidia's ability to maintain its growth trajectory may be challenged.

- Intel's Market Entry Delay: Intel's slower entry into the AI chip market may hinder its competitiveness against more established firms like Nvidia. This delay could potentially result in lost market share and diminished influence in the rapidly evolving AI landscape.

- Price Sensitivity: Pricing pressure is a common concern in the semiconductor industry, and both Nvidia and Intel may face challenges in maintaining profit margins as they compete on price with emerging rivals. This could impact their overall financial performance.

- Technological Obsolescence: The fast-paced nature of technological advancements in AI may lead to rapid obsolescence of current products. Investors may need to consider how effectively these companies can innovate to avoid falling behind.

3. Practical Options/Methods

Investors seeking exposure to the burgeoning field of artificial intelligence (AI) may consider the potential benefits of investing in AI-focused exchange-traded funds (ETFs). For instance, the Global X Robotics & Artificial Intelligence ETF (BOTZ) provides a diversified portfolio of companies involved in robotics and AI, allowing investors to capture the growth of this sector without the risks associated with individual stock investments. Historical performance indicates that sector-specific ETFs like BOTZ may experience returns that can range from 10% to 20% annually, depending on market conditions and technological advancements.

Another option is the ARK Autonomous Technology & Robotics ETF (ARKQ), which emphasizes companies engaged in autonomous technology, including those leveraging AI for advancements in transportation, automation, and energy. ARKQ has been known to have a higher volatility profile, typically yielding returns that might fluctuate between 15% to 30% during periods of significant innovation and market enthusiasm.

Additionally, utilizing cloud services powered by advanced AI chips from companies like Nvidia and Intel can provide investors with exposure to cutting-edge technology without direct equity investment. Platforms such as Amazon Web Services (AWS) and Google Cloud offer AI capabilities that leverage these chips for various applications, from machine learning to data analytics. Investors may find that these services, which could potentially reduce operational costs by 20% to 30% for businesses leveraging AI, represent a critical infrastructure supporting the growth of AI technologies.

In summary, investors looking to capitalize on the AI revolution might explore options such as AI-focused ETFs and cloud service providers utilizing advanced AI chips. Both avenues could provide significant growth potential, contingent upon ongoing technological advancements and market dynamics. As the landscape evolves, it may be prudent for investors to stay informed about emerging technologies that could reshape industries and investment strategies.

4. Important Considerations

Investors should be aware of several key considerations when navigating the landscape of technology stocks, particularly within the rapidly evolving sector of artificial intelligence (AI). One of the most significant factors is the inherent volatility associated with tech stocks. Companies in the AI space, including both established players like Nvidia Corporation (NVDA) and emerging contenders, tend to experience price fluctuations that can exceed 20-30% on a quarterly basis. This volatility may reflect broader market dynamics and investor sentiment, requiring careful risk assessment.

Another critical aspect for investors to consider is the fee structure associated with exchange-traded funds (ETFs) and the potential tax implications of investing in individual stocks. Typically, expense ratios for ETFs can range from 0.05% to 1.00%, depending on the management style and complexity of the fund. Investors should evaluate these fees against the projected returns, as high fees can erode profits over time. Additionally, capital gains taxes on individual stock sales can range from 15% to 20%, depending on the investor's income level and holding period, impacting net returns significantly.

Finally, understanding the risks tied to technological advancements is essential for informed decision-making. The fast-paced nature of innovation in the AI sector means that companies must continually adapt to remain competitive. For instance, advancements in semiconductor manufacturing processes by companies like Taiwan Semiconductor Manufacturing Company (TSM) could create both opportunities and threats for existing AI chip producers. Investors may benefit from closely monitoring these developments to assess potential impacts on stock performance.

In summary, while the AI sector presents exciting opportunities, investors must navigate the associated risks with diligence. By considering volatility, fee structures, and the rapid pace of technological change, investors can make more informed decisions as they explore potential investments in this transformative space.

5. Conclusion

The competition between Nvidia Corporation (NVDA) and Intel Corporation (INTC) in the realm of artificial intelligence (AI) chip innovation is a pivotal factor shaping the future of technology. Investors may find that the ongoing rivalry not only influences the performance of these two tech giants but also impacts the broader landscape of AI infrastructure. As Nvidia continues to enhance its advanced graphics processing units (GPUs), supported by the rapid innovation at Taiwan Semiconductor Manufacturing Company, Intel is striving to reclaim its standing through strategic investments and partnerships aimed at improving its AI offerings.

This competition may result in significant advancements in AI chip technology, which could potentially lead to improved efficiencies and capabilities across various sectors. For instance, as Google CEO Sundar Pichai has suggested, AI tools may begin to make decisions on behalf of users, spanning from financial investments to health care recommendations. Such developments indicate a shifting paradigm where AI will play an increasingly integral role in decision-making processes, thereby amplifying the need for powerful, efficient chips.

Investors should consider the implications of these developments on their strategies, as the market dynamics surrounding AI chip manufacturers could influence stock performance. The emergence of alternative chip stocks, which may offer competitive advantages, could provide new investment opportunities for those looking to diversify their portfolios. For example, some analysts have pointed to lesser-known companies that possess innovative technologies as potential breakout candidates, positioning them as the 'Nvidia of the future.'

In conclusion, the following key takeaways emerge from the current landscape:

- The competition between Nvidia and Intel is indicative of the larger trends in AI chip innovation.

- Advancements in AI may lead to transformative changes across multiple industries.

- Investors may benefit from staying informed about emerging players in the AI chip market.

- Continued monitoring of technological developments and market conditions is essential for strategic positioning.

As the technological landscape evolves, investors are reminded to conduct their own research to navigate these dynamic conditions effectively.

Disclaimer: This article was generated using AI technology and is for informational and educational purposes only. It does not constitute investment advice, recommendation, or solicitation. All investment decisions are solely the responsibility of the individual investor. Past performance does not guarantee future results. Investments involve significant risks, including the potential loss of principal. Before making any investment decisions, please conduct your own research and consult with qualified financial and tax professionals.