How Fed Rate Cuts Impact Stock Market Performance by 10-15%

1. Why Consider Fed Rate Cuts and their Impact on Stock Markets

Investors may find it crucial to understand the intricate relationship between the Federal Reserve's interest rate decisions and stock market dynamics. The Federal Reserve's interest rate, often viewed as a key economic lever, influences borrowing costs for individuals and businesses, which can subsequently impact consumer spending and investment. When the Fed lowers rates, it tends to make borrowing cheaper, potentially stimulating economic growth. This relationship often leads to increased corporate profits, which can positively influence stock prices.

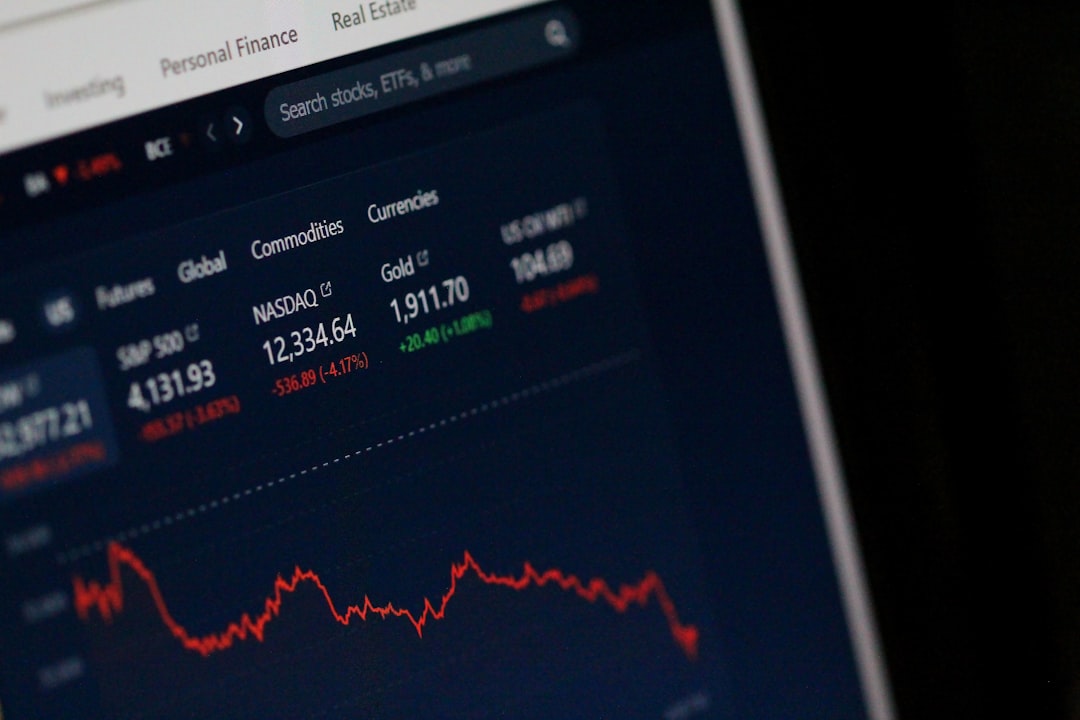

The significance of rate cuts cannot be understated, as they may serve as a catalyst for investor behavior. Lower interest rates might encourage investors to seek higher returns in the stock market, particularly when traditional fixed-income investments, like bonds, yield lower returns. This shift in investor sentiment can lead to increased demand for equities, driving stock prices upward. For instance, during periods when the Federal Reserve has cut rates by approximately 0.25% to 0.50%, historical data suggests that major indices like the S&P 500 Index (SPX) have often reacted positively, averaging gains of about 5-10% in the subsequent months following such decisions.

Examining the historical context, Fed rate cuts have frequently coincided with periods of economic recovery. For example, after significant rate reductions, the stock market has often rebounded, illustrating a correlation between lower rates and enhanced market performance. In the years following the financial crisis, the Fed's aggressive rate cuts were associated with substantial stock market gains, highlighting how investor confidence can flourish in a low-rate environment.

As investors observe the current climate, where stock futures indicate a modest rise ahead of a potential Fed rate cut, it may be beneficial to consider how these dynamics could play out in their investment strategies. Understanding the interplay between monetary policy and market sentiment might provide investors with valuable insights as they navigate the complexities of the financial landscape.

2. Advantages and Disadvantages

As investors analyze the potential implications of anticipated interest rate cuts by the Federal Reserve, it is essential to consider both the advantages and disadvantages that such monetary policy changes may bring to the financial landscape.

2.1 Potential Advantages

- Increased Liquidity: Rate cuts can lead to increased liquidity in the financial system, making capital more accessible for businesses and consumers. This can facilitate easier access to loans and credit, potentially driving economic growth.

- Encouragement of Borrowing: Lower interest rates tend to encourage borrowing and investing, which may boost corporate earnings and stock prices. As borrowing costs decline, companies might invest more in expansion or innovation, leading to improved performance in the stock market.

- Stimulated Consumer Spending: Reduced rates can lower monthly payments on existing loans, which may result in higher disposable income for consumers. As a consequence, increased consumer spending could stimulate demand for goods and services, benefiting various sectors of the economy.

- Market Confidence: The anticipation of rate cuts often leads to increased market confidence, as investors may view these actions as supportive of economic growth. This optimism can drive stock prices higher, as seen with the recent slight gains in major indexes.

2.2 Potential Disadvantages

- Signal of Economic Weakness: Rate cuts may signal underlying economic weakness. Investors might interpret these actions as a response to slowing growth or other economic challenges, leading to skepticism about the sustainability of the market rally.

- Over-Reliance on Low Rates: A sustained period of low interest rates could create over-reliance on cheap borrowing, potentially leading to asset bubbles. This situation increases the risk of market corrections, which could result in heightened volatility.

- Impact on Savings: Lower interest rates often mean reduced returns on savings accounts and fixed-income investments. This might deter conservative investors, particularly retirees who rely on stable income from their investments, potentially forcing them into riskier assets.

- Inflationary Pressure: Prolonged low rates could contribute to inflationary pressures in the economy. If demand outstrips supply as liquidity increases, investors may face a situation where purchasing power diminishes over time, complicating investment strategies.

In conclusion, while interest rate cuts can provide various benefits, they also come with inherent risks that investors should carefully weigh as they navigate the current financial environment.

3. Practical Options/Methods to Leverage Rate Cuts

As investors anticipate potential Federal Reserve interest rate cuts, exploring practical options and methods to leverage these changes may be beneficial. One avenue to consider is investing in Exchange-Traded Funds (ETFs) that historically perform well in a low-rate environment. For instance, the iShares U.S. Treasury Bond ETF (GOVT) tends to attract capital during periods of declining interest rates, reflecting a flight to safer assets. Alternatively, the Vanguard Total Stock Market ETF (VTI) could potentially yield favorable returns as lower borrowing costs may stimulate economic growth and boost equities across various sectors.

Investors might also utilize tools like stock screeners to identify sectors that typically benefit from rate cuts. Historically, sectors such as utilities and consumer discretionary have shown resilience and growth in low-rate environments. For example, utility companies often have stable cash flows and can invest in infrastructure projects at a lower cost, potentially enhancing their profitability. Similarly, consumer discretionary stocks might see increased consumer spending as individuals have more disposable income due to lower interest payments on loans and credit.

Another strategy that investors may consider is exploring dividend-paying stocks. These stocks can provide a reliable income stream, which becomes increasingly valuable when interest rates are low. Companies with a track record of consistent dividend payments, such as those within the S&P 500 Dividend Aristocrats, may offer yields ranging from approximately 2% to 5%. This approach not only allows investors to potentially benefit from capital appreciation but also provides a cushion against market volatility during uncertain economic times.

In summary, as the market reacts to anticipated rate cuts, investors may find opportunities in specific ETFs, sector-focused investments, and dividend-paying stocks. Each of these methods could serve as a means to enhance portfolio performance in a low-interest-rate landscape, allowing for strategic positioning in a potentially favorable economic environment.

4. Important Considerations

Investors navigating the current stock market landscape, particularly in light of anticipated changes in interest rates, may need to consider several important factors that could influence their investment strategies and overall financial health.

4.1 Tax Implications of Capital Gains

One significant consideration for investors is the understanding of tax implications associated with capital gains from stock sales, especially when tax rates are potentially cut. For example, if the capital gains tax rate, which can range from 0% to 20% depending on an investor's income level, is reduced, investors might find it more advantageous to realize gains now rather than later. This could potentially yield greater after-tax returns on investments, particularly for those holding appreciated assets in taxable accounts.

4.2 Fees Associated with Trading

Investors should also be aware of the fees associated with trading Exchange-Traded Funds (ETFs) or mutual funds, which can significantly impact net returns. Management fees for mutual funds typically range from 0.5% to 2%, while ETFs may charge expense ratios between 0.05% and 0.75%. Additionally, trading commissions can further erode profits, especially for investors who trade frequently. Therefore, it is crucial for investors to factor in these costs when evaluating potential investments, as high fees can diminish overall performance over time.

4.3 Evaluating Risks

Lastly, evaluating the risks associated with market volatility and the potential for interest rate hikes is essential. The stock market is inherently volatile, and fluctuations can be exacerbated by external economic conditions. For instance, if interest rates rise, borrowing costs could increase, potentially slowing economic growth and impacting market performance. Investors may want to consider diversifying their portfolios to mitigate these risks, potentially allocating assets across different sectors or investment vehicles to achieve a more balanced exposure.

In summary, understanding the interplay between tax implications, associated fees, and market risks can empower investors to make more informed decisions in an evolving financial landscape. As they continue to monitor economic indicators and Federal Reserve announcements, keeping these considerations in mind may enhance their investment strategies moving forward.

5. Conclusion

In summary, the impact of Federal Reserve (Fed) rate cuts on stock market performance can be multifaceted. Historically, when the Fed lowers interest rates, it tends to stimulate economic activity by making borrowing cheaper for both consumers and businesses. This could potentially lead to increased spending and investment, which may bolster corporate earnings and, in turn, support stock prices. For instance, during past rate cut cycles, sectors such as technology and consumer discretionary often outperform, as lower rates can enhance growth prospects for companies within these industries.

However, it is important for investors to adopt a nuanced approach when responding to Fed policy changes. A rate cut does not guarantee immediate gains in the stock market, as investor sentiment and external economic factors also play significant roles. For example, during periods of economic uncertainty or geopolitical tensions, even a favorable monetary policy shift may not result in the anticipated stock market rally. As recent market behavior suggests, investors may exhibit caution, leading to mixed responses in global markets ahead of key Fed announcements.

Investors should remain vigilant and stay informed about ongoing Fed policies, as these decisions can influence market dynamics and affect investment strategies. Monitoring indicators such as the Fed's balance sheet and economic forecasts can provide valuable insights into potential market movements. Additionally, considering a diversified investment approach—such as utilizing ETFs like SPY (SPDR S&P 500 ETF Trust) or QQQ (Invesco QQQ Trust)—may help mitigate risks associated with market volatility.

In conclusion, understanding the interplay between Fed rate cuts and stock market performance is crucial for investors. As conditions evolve, continually assessing both macroeconomic indicators and personal investment strategies may be beneficial. To stay updated on market trends and enhance investment decision-making, consider subscribing for more insights and analyses on this dynamic landscape.

Disclaimer: This article was generated using AI technology and is for informational and educational purposes only. It does not constitute investment advice, recommendation, or solicitation. All investment decisions are solely the responsibility of the individual investor. Past performance does not guarantee future results. Investments involve significant risks, including the potential loss of principal. Before making any investment decisions, please conduct your own research and consult with qualified financial and tax professionals.