How AI Investment in Semiconductors Drives Market Growth

1. Why Consider AI Investment in Semiconductors

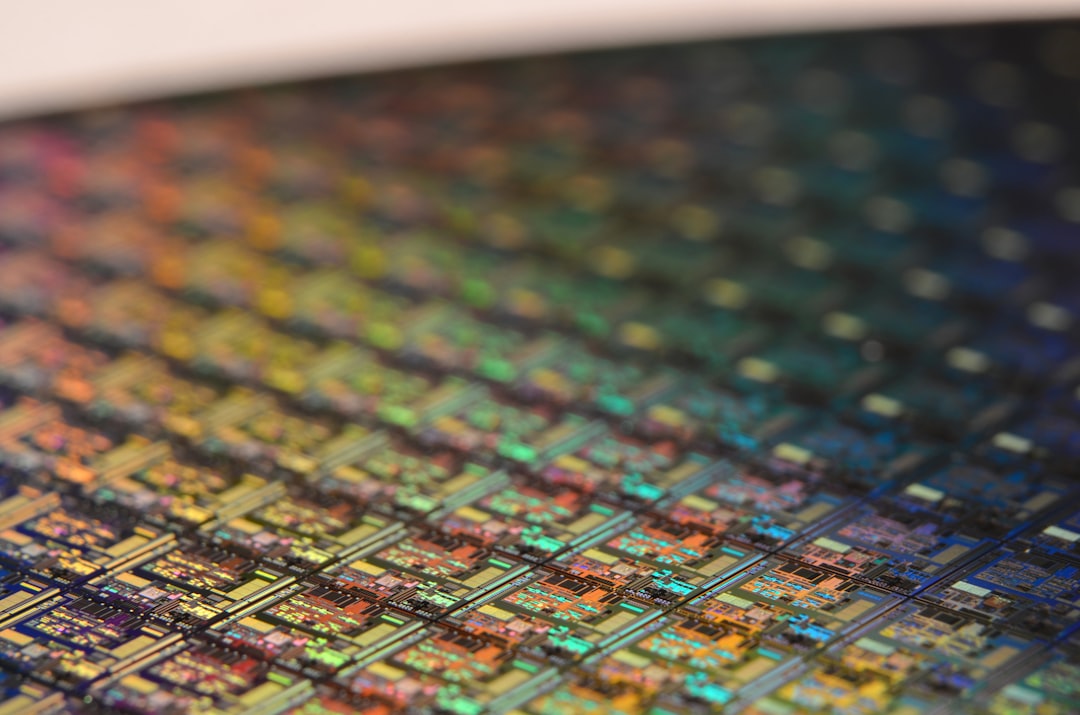

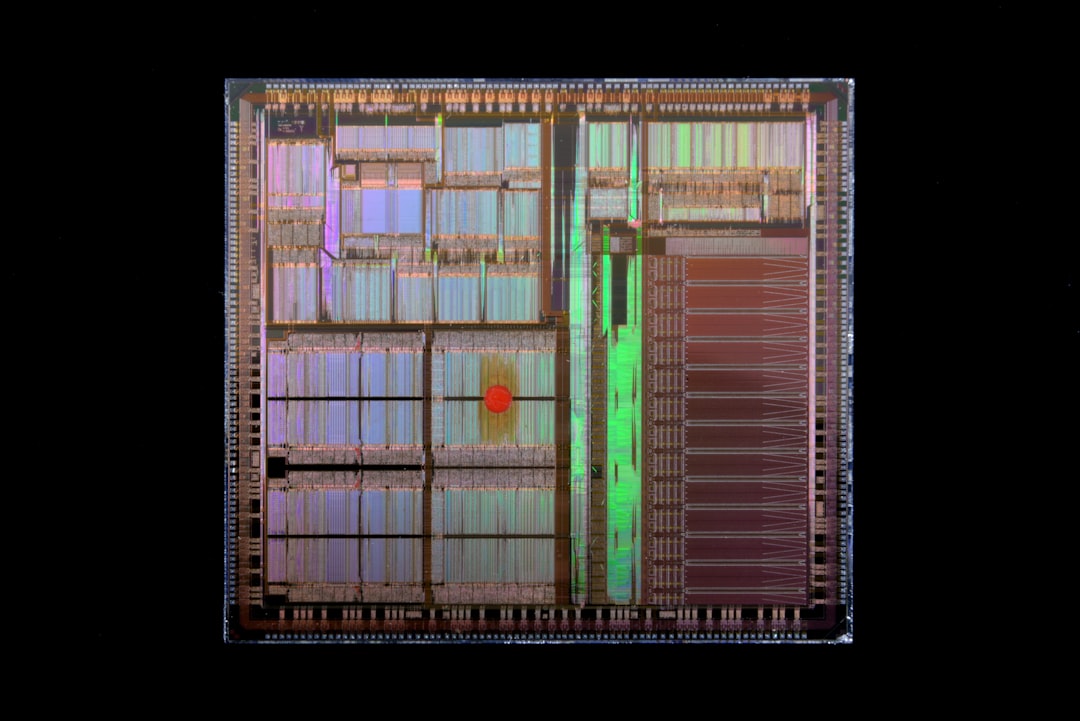

Investors may find the intersection of artificial intelligence (AI) and the semiconductor industry to be a compelling area for consideration. As AI applications proliferate across various sectors, the demand for advanced semiconductor technology is experiencing significant growth. The reliance of AI on these technologies is becoming increasingly apparent, as the performance of AI systems is heavily dependent on the capabilities of the underlying hardware, particularly in areas like data processing and machine learning.

According to industry reports, the global semiconductor market is anticipated to reach approximately $1 trillion by 2030, driven largely by the growing demand for AI and machine learning applications. This represents a compound annual growth rate (CAGR) of around 5% to 7% over the next decade. Major players in the semiconductor sector, such as Nvidia Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD), have shown robust revenue growth, often attributed to their strategic positioning within the AI space. For instance, Nvidia has been noted for its dominance in GPU technology, which is critical for AI processing, while AMD has gained traction with its competitive offerings in both CPU and GPU markets.

Understanding this synergy between AI and semiconductors may provide investors with valuable insights into market trends and potential investment opportunities. Investors may consider examining exchange-traded funds (ETFs) focused on the semiconductor sector, such as the XSD (SPDR S&P Semiconductor ETF) or SOXX (iShares PHLX Semiconductor ETF), which could offer diversified exposure to this rapidly evolving market.

Furthermore, as companies like Oracle Corporation (ORCL) make significant strides in AI technologies, their earnings reports may influence investor sentiment and stock valuations within the semiconductor sector. This dynamic highlights the potential volatility associated with AI-related investments, as market reactions may not only depend on the performance of individual companies but also on broader economic indicators and regulatory developments.

Investors might also want to explore the recent interest from major funds in AI startups, such as the discussions involving SoftBank and Nvidia regarding a substantial investment in Skild AI. Such movements could signal greater confidence in AI's future, further propelling semiconductor stocks. Overall, as the AI landscape continues to evolve, the semiconductor industry may offer numerous opportunities for investors willing to navigate its complexities.

2. Advantages and Disadvantages

Investors in the semiconductor sector, particularly those focusing on artificial intelligence (AI) applications, may find themselves navigating a landscape filled with both promising opportunities and notable risks. Understanding the potential advantages and disadvantages associated with this investment segment is crucial for making informed decisions.

2.1 Potential Advantages

- Enhanced Performance: AI has the potential to significantly enhance the performance and efficiency of semiconductor devices. This improvement can lead to increased sales and market demand as businesses and consumers seek out advanced technologies.

- Portfolio Diversification: Investing in semiconductor companies that focus on AI applications may provide a means for portfolio diversification. Given the rapid growth in the AI sector, companies like Advanced Micro Devices, Inc. (AMD) and Nvidia Corporation (NVDA) could potentially yield higher returns compared to traditional sectors.

- Market Growth: The semiconductor industry is expected to grow at a compound annual growth rate (CAGR) of approximately 5-7% over the next several years, driven largely by AI advancements. This growth may create new investment opportunities in companies that adapt to and capitalize on AI technologies.

- Strategic Partnerships: Collaborations between leading tech companies and semiconductor firms can bolster innovation. For instance, SoftBank and Nvidia's discussions regarding substantial investments illustrate the enthusiasm surrounding AI and robotics, potentially benefiting investors in these sectors.

2.2 Potential Disadvantages

- Market Volatility: Semiconductor stocks tend to be susceptible to market volatility, particularly those heavily tied to AI performance. Investors may experience significant price fluctuations based on market sentiment and external economic factors, which can lead to potential losses.

- Overvaluation Risks: As excitement around AI technologies grows, there may be a risk of overvaluation in semiconductor stocks. Hype can inflate stock prices beyond their fundamental values, making it challenging for investors to accurately assess the true worth of their investments.

- Dependency on Cyclical Trends: The semiconductor industry is often influenced by cyclical trends. Economic downturns can lead to decreased demand for electronics, which could adversely affect companies focused on AI applications, thereby impacting stock performance.

- Technological Risks: Rapid advancements in technology mean that companies must continuously innovate to stay relevant. Failure to keep pace with AI developments could result in a decline in market position for semiconductor firms, affecting investor returns.

As investors weigh these advantages and disadvantages, careful consideration of market dynamics and individual company performance is essential before making investment choices in the semiconductor sector.

3. Practical Options/Methods

Investors may explore several practical options and methods to gain exposure to the burgeoning semiconductor sector, particularly in the context of artificial intelligence (AI) advancements. One viable avenue is through exchange-traded funds (ETFs) such as the iShares PHLX Semiconductor ETF (SOXX). This ETF provides diversified exposure to a variety of semiconductor companies, potentially mitigating individual stock risks while capitalizing on the industry's overall growth trajectory.

For those interested in more targeted investments, individual stocks such as Nvidia Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD) represent prominent players in AI-focused semiconductor technology. Nvidia, known for its graphics processing units, has been increasingly pivotal in AI applications, while AMD has garnered attention for its competitive positioning and recent analyst upgrades. For instance, analysts have noted that AMD may be one of the fastest-growing semiconductor stocks, with some reports indicating double-digit percentage gains in market interest due to its AI-related ventures.

To further enhance investment decisions, utilizing analytical tools like Stock Rover or Morningstar can be instrumental. These platforms provide comprehensive financial analysis and performance tracking, allowing investors to assess key metrics such as price-to-earnings ratios, revenue growth rates, and market trends. Typically, semiconductor companies might exhibit price-to-earnings ratios ranging from 15% to 25%, depending on their growth prospects and market conditions.

As investors consider these options, it is essential to remain aware of the broader market dynamics, particularly the pivotal earnings reports and ongoing developments in the AI sector that could influence stock performance. Monitoring these factors may provide insights into potential investment strategies in this rapidly evolving marketplace.

4. Important Considerations

Investors should consider several important factors when navigating the semiconductor sector, especially in light of the growing demand fueled by artificial intelligence (AI). One key area of concern is the potential tax implications associated with capital gains. When investors sell semiconductor stocks that have appreciated due to heightened AI demand, they may face capital gains taxes that could significantly impact their overall returns. Typically, long-term capital gains tax rates range from 0% to 20%, depending on the investor's income level, which underscores the importance of strategic tax planning when realizing profits.

Additionally, those investing in exchange-traded funds (ETFs) focused on semiconductor stocks should be aware of the management fees associated with these funds. Management fees can vary widely, generally falling within the range of 0.5% to 1.5% of assets under management. While these fees may appear modest, they can erode overall returns, particularly over the long term. For instance, a 1% management fee on a portfolio that grows at an annual rate of 7% could reduce the investor's returns by approximately 25% over a 30-year period.

Moreover, investors must remain cognizant of the risks inherent in the semiconductor industry, particularly with rapid technological advancements. Competitors may be developing new technologies that could potentially outpace current investments in AI semiconductor technology. For example, if a rival company introduces a groundbreaking AI chip that offers significantly better performance or lower production costs, it could diminish the market position of existing players like Advanced Micro Devices, Inc. (AMD) or Nvidia Corporation (NVDA). Such developments highlight the need for investors to stay informed about industry trends and competitive dynamics.

In conclusion, while the semiconductor sector presents opportunities driven by AI demand, investors must navigate tax implications, management fees, and competitive risks to optimize their investment strategies effectively.

5. Conclusion

As the landscape of technology continues to evolve, the role of artificial intelligence (AI) investment in semiconductors emerges as a crucial driving force behind market growth. This sector may present both substantial opportunities and inherent risks for investors. For instance, companies like Advanced Micro Devices, Inc. (AMD) have garnered attention for their significant advancements in AI capabilities, leading to increased buy ratings from analysts. Similarly, Nvidia Corporation (NVDA) is often highlighted for its long-term revenue potential, particularly in AI-driven markets.

Investors should conduct thorough research to assess the balance of advantages and disadvantages associated with semiconductor investments influenced by AI. On one hand, the growth in AI technologies could potentially yield gains as demand for advanced chips surges, driving revenue for semiconductor companies. On the other hand, the volatility of the AI market, particularly as it relates to broader economic conditions and regulatory changes, may pose risks that cannot be overlooked.

For instance, recent discussions around potential investments in AI startups, such as SoftBank's negotiations regarding Skild AI, underscore the rising enthusiasm for robotics models and AI capabilities. However, the fluctuations in stock performance, as evidenced by the recent earnings anticipation from Oracle Corporation (ORCL), illustrate the unpredictable nature of the market. Earnings reports can significantly influence stock prices, which may lead to both upward momentum and downward corrections depending on the outcomes.

In conclusion, investors may want to consider starting to explore semiconductor-related investments today to capitalize on the growth of AI technology, while keeping in mind the associated risks. Monitoring market conditions, analyst ratings, and technological advancements will be essential as the AI landscape continues to develop. Ultimately, conducting diligent research is paramount to making informed investment decisions in this dynamic sector.

Disclaimer: This article was generated using AI technology and is for informational and educational purposes only. It does not constitute investment advice, recommendation, or solicitation. All investment decisions are solely the responsibility of the individual investor. Past performance does not guarantee future results. Investments involve significant risks, including the potential loss of principal. Before making any investment decisions, please conduct your own research and consult with qualified financial and tax professionals.