How AI Adoption Boosts Semiconductor Stocks by 15%

1. Why Consider AI Adoption in Semiconductor Stocks

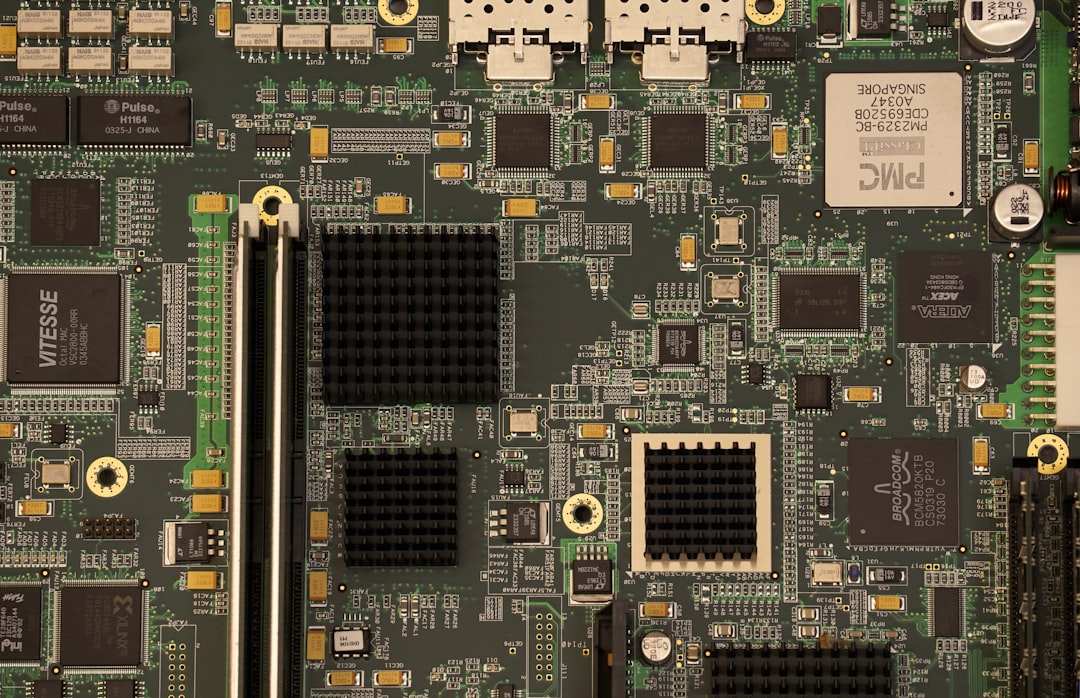

Investors may find the intersection of artificial intelligence (AI) and semiconductor manufacturing increasingly significant as the demand for advanced computing capabilities continues to rise. The semiconductor industry is evolving rapidly, with AI playing a critical role in driving innovation and efficiency. For instance, the development of custom silicon chips tailored for AI workloads, such as the Rivian Autonomy Processor (RAP1), illustrates how companies are prioritizing AI integration to enhance performance and capabilities.

As AI adoption expands, the semiconductor industry could potentially experience substantial growth. Analysts project that AI-related semiconductor revenue may account for approximately 20-30% of the overall market by 2025. This shift suggests that companies heavily invested in AI technology may outperform their peers, particularly in terms of profitability margins, which typically range from 10-15% for semiconductor firms specializing in AI applications compared to 5-10% for traditional manufacturers.

Investors should also pay attention to the correlation between AI advancements and semiconductor stock performance. As highlighted by the recent announcements from industry leaders like Broadcom and Rivian, the momentum behind AI adoption may signal strong future demand for semiconductors. For example, the easing of chip supply constraints in key markets could catalyze a significant AI capital expenditure boom, particularly in regions like China, which could experience growth rates of up to 25% in AI investment.

Moreover, companies that successfully leverage AI for their semiconductor production processes may achieve a competitive edge, leading to improved operational efficiencies and cost reductions. This could further enhance their market positions and, subsequently, their stock valuations. Investors may view these developments as critical indicators when assessing potential investment opportunities within the semiconductor sector.

In summary, understanding the growing intersection between AI and semiconductor manufacturing could provide valuable insights into the industry's future trajectory and profitability. As investors evaluate their portfolios, monitoring these trends may yield significant strategic advantages.

2. Advantages and Disadvantages

Investors may find that the ongoing integration of artificial intelligence (AI) within various sectors, particularly in semiconductor industries, presents both advantages and disadvantages worth considering.

2.1 Potential Advantages

- Increased Demand: The rising adoption of AI-driven applications could lead to a significant uptick in semiconductor sales, as these technologies require advanced chips for optimal performance.

- Innovations in Custom Chips: Companies are developing custom chips that enhance performance, potentially opening new markets. For example, the introduction of specialized chips by firms like Rivian Automotive (NASDAQ:RIVN) may redefine capabilities in the electric vehicle sector.

- Stock Appreciation: Major players in the semiconductor field, such as Nvidia Corporation (NASDAQ:NVDA) and Broadcom Inc. (NASDAQ:AVGO), have showcased substantial stock appreciation, often attributed to their pivotal roles in AI adoption. This could be reflective of a broader trend where companies aligned with AI technologies may see increased investor interest.

- Market Expansion: The potential growth of AI investments, especially in regions like China, could lead to a capital expenditure boom in the semiconductor sector, as easing chip shortages may facilitate more expansive AI infrastructure investments.

2.2 Potential Disadvantages

- High Investment Costs: The research and development associated with AI technology tends to require significant financial resources, which may deter smaller companies from entering the market.

- Market Volatility: Semiconductor stocks may experience heightened volatility, often linked to rapid shifts in technology trends. This could result in fluctuating investor confidence and stock valuations.

- Supply Chain Challenges: The semiconductor industry may face ongoing supply chain disruptions, which can potentially hinder production and lead to global chip shortages, ultimately affecting the ability to meet the increasing demand driven by AI applications.

- Dependency on Technology Trends: The reliance on prevailing tech trends means that a shift in consumer or business preferences could adversely impact companies heavily invested in AI technologies.

As the landscape of AI continues to evolve, investors might weigh these potential advantages and disadvantages carefully. Understanding the broader implications for the semiconductor market could be critical in making informed investment decisions.

3. Practical Options/Methods

Investors may find it beneficial to explore various options and methods for gaining exposure to the semiconductor sector, particularly in light of the accelerating adoption of artificial intelligence (AI) technologies. One approach is to invest in exchange-traded funds (ETFs) such as the iShares PHLX Semiconductor ETF (SOXX) and the VanEck Vectors Semiconductor ETF (SMH). These ETFs provide diversified exposure to a broad range of semiconductor companies, potentially mitigating the risks associated with investing in individual stocks. Historically, semiconductor ETFs have demonstrated returns in the range of 15-20% annually, which could appeal to investors seeking growth in the tech sector.

Additionally, investors may consider focusing on individual stocks that are at the forefront of AI advancements. For instance, companies like Nvidia Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD) have made significant investments in AI technology, positioning themselves as leaders in this burgeoning field. Nvidia, in particular, has seen its stock price increase significantly, driven by its dominance in the AI chip market, which could suggest a strong growth trajectory for the future.

Another practical method for investors is to utilize accessible investment platforms such as Robinhood or E*TRADE. These platforms offer user-friendly interfaces and commission-free trading, allowing investors to easily buy and sell semiconductor stocks without incurring hefty fees. This ease of access may encourage more investors to participate in the semiconductor market, particularly as the sector is poised for growth, driven by trends in AI and increased demand for innovative technologies.

As the semiconductor industry continues to evolve, with companies like Rivian Automotive, Inc. (RIVN) announcing their own AI ambitions and custom chips, it may present further opportunities for savvy investors. This dynamic landscape underscores the importance of staying informed and adapting investment strategies to align with industry developments. The potential for significant returns in this sector could make ongoing scrutiny essential for investors keen on capitalizing on market trends.

4. Important Considerations

Investors considering semiconductor stock investments should carefully evaluate several important considerations to inform their decision-making process. One critical aspect is understanding the tax implications of capital gains. In many jurisdictions, long-term capital gains may be taxed at a lower rate compared to short-term gains, which could range from 0% to approximately 20% based on income levels. Investors might find it beneficial to hold semiconductor stocks for more than a year to potentially reduce their tax burden, thereby maximizing their after-tax returns.

Another vital consideration involves management fees associated with exchange-traded funds (ETFs) and mutual funds that focus on the semiconductor sector. These fees can significantly impact overall investment performance over time. For instance, management fees typically range from about 0.5% to 1.5% for ETFs, while mutual funds might charge between 1% and 2%. Investors should assess whether the potential benefits of these funds, such as diversification and professional management, justify their costs.

Additionally, assessing the risks involved in semiconductor investments is essential. The semiconductor market can be highly volatile, influenced by factors such as technological advancements, supply chain disruptions, and fluctuating demand. For example, increased investment in **artificial intelligence** (AI) could lead to potential overvaluation of stocks in this space, especially for companies like Nvidia Corporation (NVDA) and Rivian Automotive (RIVN) that are heavily tied to AI developments. Investors may need to monitor market conditions closely, as significant downturns can lead to sharp declines in stock prices, particularly if valuations do not align with fundamental performance.

In summary, while semiconductor investments may present attractive opportunities, investors must navigate the complexities of tax implications, management fees, and market risks. By doing so, they can make more informed decisions that align with their financial goals.

5. Conclusion

In conclusion, the adoption of artificial intelligence (AI) is poised to have a significant impact on the semiconductor sector, particularly regarding semiconductor stocks. As highlighted by recent commentary from Broadcom CEO Hock Tan, the increasing integration of AI technologies is likely to drive demand for advanced semiconductor solutions. This trend may contribute to a potential boost of around 15% in stock values for companies operating within this space, especially for those directly involved in AI chip production.

Investors may find it beneficial to explore the investment opportunities that arise from this growing sector. Companies like Nvidia Corporation (NVDA) and Broadcom Inc. (AVGO) are at the forefront of AI semiconductor production, while newer entrants such as Rivian Automotive (RIVN) are also beginning to carve out their niches with innovative AI technologies. The anticipated easing of chip supply constraints could further stimulate investments in AI applications, particularly in markets like China, which are projected to ramp up their capital expenditures in AI as supply conditions improve.

Moreover, diversifying portfolios to include semiconductor investments might be a prudent strategy for investors looking to capitalize on the ongoing technological revolution. Given the dynamic nature of the semiconductor market, characterized by rapid advancements and the increasing relevance of AI, investors should consider carefully monitoring the developments and performance of semiconductor stocks.

- The ongoing integration of AI may drive semiconductor demand and stock performance.

- A potential 15% increase in semiconductor stocks could be on the horizon.

- Investors should assess companies pioneering in AI chip technologies.

- Diversification into semiconductor investments may provide growth opportunities.

As conditions evolve, maintaining an informed perspective on market dynamics will be essential. Investors are encouraged to conduct thorough research to identify the most promising opportunities within the semiconductor sector.

Disclaimer: This article was generated using AI technology and is for informational and educational purposes only. It does not constitute investment advice, recommendation, or solicitation. All investment decisions are solely the responsibility of the individual investor. Past performance does not guarantee future results. Investments involve significant risks, including the potential loss of principal. Before making any investment decisions, please conduct your own research and consult with qualified financial and tax professionals.